Budget Planner & Expense Tracker Notebook: Your Ultimate Financial Companion

Managing finances can be a daunting task, but the right tools can make all the difference. The Budget Planner and Expense Tracker Notebook stands out as a practical solution for anyone looking to take control of their financial journey. With its comprehensive sections for goals, savings, debts, and expenses, it offers a structured approach to budgeting. The high-quality 100gsm paper ensures durability, while the portable A5 size makes it easy to carry anywhere. With an undated format, users can begin at any time, making it adaptable to their unique financial situations. This notebook is more than just a planner; it’s a reliable companion for effective financial management.

Budget Planner & Expense Tracker Notebook

The “Budget Planner – Monthly Finance Organizer with Expense Tracker Notebook” is an essential tool for individuals seeking to regain control of their finances. This planner is thoughtfully designed with dedicated sections to outline financial goals, track savings, manage debts, and document daily expenses. By facilitating an organized approach to budgeting, it empowers users to understand their financial landscape comprehensively. With features such as a monthly budget and a monthly budget review, this finance planner serves as an excellent companion for anyone aiming to manage their money effectively.

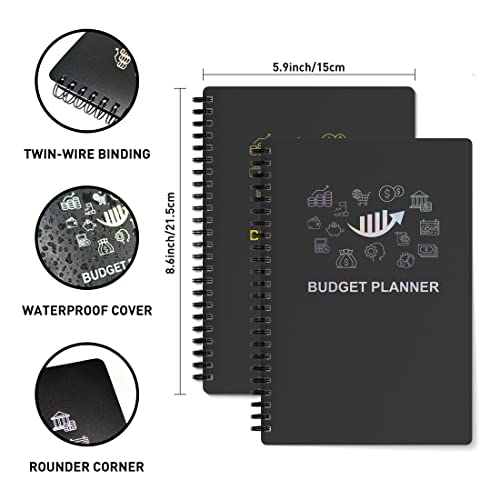

Quality is paramount in the construction of this budget planner. It is crafted from premium 100gsm paper, which significantly reduces issues related to ink leakage, fraying, and shading; this ensures that users can write freely without the worry of damaging the pages. The planner also boasts a sturdy and flexible cover that protects its contents, while the metal lay-flat twin-wire binding provides durability and longevity, making it a reliable resource that stands the test of time.

This planner facilitates organized monthly goal setting and budget planning through its 12-month layout. Users can effectively outline monthly financial objectives, monitor budgets, track expenditures, and strategize for the future. Each page serves as a framework for establishing good monetary habits and creating actionable plans for financial success. The thoughtful inclusion of reminders for bills and payments encourages accountability in managing finances.

Additionally, the undated nature of the finance planner enhances its flexibility, allowing it to be utilized at any time and place. With a compact size of 8.6×5.9 inches, it easily fits into any bag, making it accessible for daily use. Ultimately, the “Budget Planner” not only aids in tracking monetary flow but also sets individuals on a path toward long-term financial freedom, making it an invaluable addition to anyone’s financial toolkit.

Budget Planner – Monthly Finance Organizer

Managing finances can often feel daunting, but with the right tools, it can become a manageable task. The Budget Planner – Monthly Finance Organizer with Expense Tracker Notebook is designed specifically to help individuals take control of their finances. This undated planner allows you to start any time of the year, making it a flexible solution for anyone looking to track their expenses and budget effectively.

Key Features

The Budget Planner is filled with essential features that provide a comprehensive approach to managing personal finances.

- Flexible Layout: It includes sections for monthly income, expenses, savings goals, and even debt tracking, helping users see the full picture of their financial health.

- High-Quality Materials: The planner is made from 100gsm paper, preventing ink bleed-through and ensuring durability, while the sturdy cover adds to its longevity.

- Motivational Quotes: Each month begins with an inspiring quote, designed to keep you motivated on your financial journey.

- Extra Organizational Tools: Additional spaces for notes, bill trackers, and unexpected expenses ensure that nothing gets overlooked in your budgeting process.

Benefits of Using the Budget Planner

Users highly appreciate the simplicity and effectiveness of this financial organizer. One reviewer highlighted that the planner transformed their approach to budgeting by allowing them to easily keep track of expenses. It features a small, sleek design, which makes it portable enough to carry around, allowing users to access their financial information whenever necessary, whether at work, during lunch breaks, or while waiting in waiting rooms.

Practical Tips for Use

To make the most of your Budget Planner, consider the following tips:

- Establish Monthly Goals: Begin each month by setting clear financial goals. This might include saving for a specific item or reducing discretionary spending.

- Track Every Expense: Write down every purchase, no matter how small, to gain a clearer picture of where your money goes. This can help identify spending habits.

- Utilize the Stickers: Use the included stickers creatively as reminders for bills or financial tasks, making budgeting a more enjoyable process.

- Review Regularly: At the end of each month, review what worked and what didn’t in your budget, adjusting your plans for the following month accordingly.

User Experience

Users are particularly fond of the planner’s quality. Many have noted the thickness of the pages, which allows for smooth writing with various pens without any bleed-through. The pockets and additional spaces further enhance its organizational ability. Additionally, while some users expressed a desire for more color options, the overall design has received praise for its simplicity and functionality.

Conclusion

In summary, the Budget Planner – Monthly Finance Organizer is a valuable tool for anyone seeking an organized, straightforward approach to managing their finances. Its durable design and comprehensive features make it suitable for users with various budgeting needs. Whether you’re a seasoned budgeter or just getting started, this planner can help simplify your financial management, enabling you to achieve your financial goals with confidence.

Regolden Budget Planner: Undated Monthly Journal with Pockets & Expense Tracker

Explore Cost-Effective Alternatives to Manage Your Finances Effectively!

Comprehensive Buyer Guide: Selecting the Right EveryDollar Budget Planner

Managing finances effectively is crucial for maintaining a healthy budget and achieving your financial goals. The EveryDollar Budget Planner is a valuable tool designed to help you track your expenses, organize your budget, and streamline your financial planning. This buyer guide will offer key considerations and steps to make an informed decision when selecting this budget planner.

Key Considerations

Before purchasing a budget planner, consider the following factors:

1. Purpose and Functionality

- Determine what you need the planner for:

- Monthly expense tracking

- Budgeting for specific categories (utilities, groceries, entertainment, etc.)

- Financial goal setting

2. Format and Size

- Choose a format that suits your lifestyle:

- Undated Planner: Allows flexibility to start at any time.

- Physical Size: The A5 (8.6 x 5.9 inches) is portable and easy to carry.

- Evaluate if you prefer a digital format or a physical planner.

3. Paper Quality

- The quality of paper is important for durability:

- Opt for planners with at least 100gsm paper to prevent bleed-through from pens or markers.

4. Organization Layout

- Look for an intuitive layout that includes:

- Monthly budget templates

- Expense tracking pages

- Goal-setting sections

- A well-organized planner can simplify your finance management.

5. Additional Features

- Check for any extra materials that would add value:

- Tips for budgeting

- Financial goal tracking

- Spare pages for notes or additional planning

Steps to Make an Informed Decision

Step 1: Assess Your Financial Goals

- Clearly define your financial objectives:

- Short-term goals (saving for a vacation)

- Long-term goals (retirement savings)

Step 2: Research Different Options

- Explore various budget planners on the market:

- Compare features, prices, and customer reviews for the EveryDollar Budget Planner.

- Look for recommendations from trusted sources or financial experts.

Step 3: Evaluate Your Lifestyle

- Consider how often you will use the planner:

- Daily use may require a planner that is easily accessible.

- If you prefer notetaking, ensure the layout accommodates writing.

Step 4: Set a Budget

- Determine your budget for the planner, taking into account:

- Price of the planner itself

- Additional items such as pens, stickers, or organizational tools

Step 5: Read Reviews

- Engage with online reviews to gauge user satisfaction:

- Positive experiences will highlight the planner’s effectiveness.

- Look for feedback on layout usability, size, and overall functionality.

Tips for Effective Use

- Consistency is Key: Regularly update your planner to maintain an accurate record of your finances.

- Review Monthly: Set aside time each month to review your spending and adjust your budget as necessary.

- Be Honest: Track every expense, even small ones, as they can add up.

- Set Realistic Goals: Define achievable financial targets to stay motivated.

Summary

Selecting the right EveryDollar Budget Planner involves careful consideration of its purpose, format, paper quality, organization layout, and additional features. By defining your financial goals, researching available options, and evaluating your lifestyle, you can make an informed decision. Remember to assess your budget and read customer reviews for a complete picture of the planner’s effectiveness. Lastly, employing the tips for effective use will maximize your budgeting potential and help secure your financial future.

With these guidelines, you are well-equipped to choose a planner that meets your financial management needs and contributes to your financial well-being.

Enhance financial stability with the Budget Planner, designed for effective money management and organized expense tracking. With its undated format and compact size, it’s easy to integrate into any lifestyle, making it the ideal companion for anyone looking to take control of their finances.